Recover 15% more from your old A/R | RCM Nexus LLC

Let’s be honest for a second. When you look at your aging accounts receivable report, what do you feel? A little overwhelmed? A touch of dread?

You’re not alone. That column labeled “90+ days” isn’t just a number on a spreadsheet—it’s your practice’s hard-earned money, sitting in limbo. And for most clinics and hospitals I’ve worked with, it’s a lot more money than they realize.

The good news? That old A/R isn’t a lost cause. In fact, it’s one of the fastest ways to inject cash back into your practice without seeing a single new patient. I’ve helped teams recover an average of 15% more revenue just by shifting their approach to these aging claims. The secret isn’t working harder; it’s working smarter with a clear system.

Stick with me, and I’ll walk you through exactly how to do it.

Why Your Old A/R is a Gold Mine (And Why You’re Not Mining It)

First, let’s change your mindset. Those old balances aren’t just “bad debt.” Think of them as low-hanging fruit. The work has already been done—the service was provided. Now it’s just about collecting what you’re rightfully owed.

The biggest mistake I see? Practices treat all old A/R the same. They send the same generic statement to a 120-day-old patient balance as they do to a 35-day-old insurance claim. That’s like using a bulldozer to plant a seed. It won’t work.

To recover real money, you need a targeted, surgical approach.

Your 5-Step A/R Recovery System

This isn’t theory. This is the same step-by-step plan we use with our clients at RCM Nexus to systematically unlock trapped cash. Implement it over the next 30 days, and you will see results.

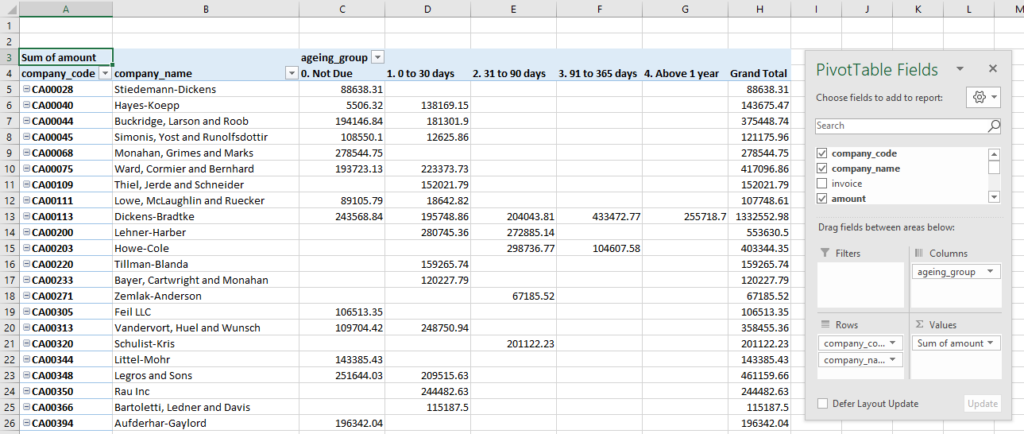

Step 1: The Triage – Know What You’re Actually Chasing

You can’t fix what you don’t measure. Start by pulling a detailed A/R aging report right now. Don’t just look at the totals. Break it down into categories:

- Insurance A/R (60+ days): These are your denials, underpayments, and pending inquiries.

- Patient A/R (60+ days): These are patient responsibility balances after insurance.

- Small Balances (<$25): Is the cost to collect them even worth it?

Step 2: Prioritize the “Quick Wins”

Not all old accounts are created equal. Focus your energy where it will have the biggest, fastest impact. Use this simple priority matrix:

PRIORITY 4 (Analyze & Write Off): Tiny balances and accounts over 1 year. Sometimes, writing off a $10 balance saves $50 in staff time. Make a business decision.

PRIORITY 1 (Attack First): Insurance balances 60-120 days old. These often just need a focused phone call or a corrected claim. The payer has the money; you just need to navigate their process.

PRIORITY 2 (Schedule Time For): Patient balances 60-120 days old. These require a more personal touch—a compassionate phone call to set up a payment plan.

PRIORITY 3 (Batch Process): Denials over 120 days. Check timely filing limits first. If you can still appeal, do it in batches by denial reason.

Step 3: Execute the Right Follow-Up Tactic

This is where the magic happens. Use the right tool for each job.

For Denials: Stop re-submitting and start appealing. A strong, formal appeal letter with supporting documentation (medical notes, prior auth) has a much higher success rate than just hitting “submit” again.

For Old Insurance Claims: Pick up the phone. The online portal is for initial submission. A 5-minute call to the payer’s provider service line can resolve what months of automated requests cannot. Have your claim info ready.

For Old Patient Balances: Switch from statements to conversations. A empathetic, non-accusatory call works wonders. “Hi [Patient Name], I’m calling from [Practice Name] to help you resolve your remaining balance of [$X]. We want to find an option that works for your budget.” Offer a payment plan upfront.

Step 4: Remove the Roadblocks to Payment

Often, the reason you haven’t been paid is a simple, fixable barrier.

- Update Patient Information: Old addresses and phone numbers guarantee no payment. Use a patient information update service or include update requests in all communications.

- Clarify Patient Statements: Is your statement confusing? Can patients easily see what they owe and why? Test it on someone outside your office. Make payment instructions crystal clear and offer multiple ways to pay (online, phone, etc.).

- Train Your Front Desk: Empower them to collect copays and old balances at check-in. A simple, polite script is key: “I see you have a previous balance of $50. Would you like to take care of that today?”

Step 5: Build a System So It Doesn’t Happen Again

Recovering 15% is great. Preventing that 15% from getting stuck again is a game-changer.

Celebrate the Wins: Track how much recovered revenue your team brings in each month. Recognize their effort. It turns a chore into a mission.

Implement a Weekly A/R Review: Every Monday, review balances aging past 45 days. Nip problems in the bud.

Set Clear Policies: Have—and communicate—clear financial policies for patients. Know your state’s laws about collections.

Conclusion: Your Cash is Waiting. Go Get It.

That old A/R report doesn’t have to be a source of stress. Start seeing it for what it truly is: an opportunity. An opportunity to improve your cash flow, to reward your team for effective recovery, and to build stronger financial systems for the future.

The single most important thing you can do is to start. Today. Pick one category from Step 2—maybe those 60-90 day insurance claims—and dedicate one hour this afternoon to making calls. You’ll be shocked at what you can recover.

And if you’re tired of chasing this alone, or if you’ve hit a wall with particularly stubborn old accounts, we’re here to help.