Stop Denials in 30 days: Fix Top 5 Medical

Billing errors | RCM Nexus LLC

Hey there, I need to ask you something straight: How many times this week have you or your billing team muttered “denied again” through gritted teeth?

If you’re like most practice managers and healthcare providers I’ve worked with over the years, that phrase has become an unwanted mantra. That sinking feeling when another claim gets rejected isn’t just frustrating—it’s money literally disappearing from your practice’s bank account.

Here’s the good news I’ve discovered after helping dozens of practices transform their revenue cycle: Most claim denials come from the same handful of mistakes. And the even better news? You don’t need a miracle to fix them. With the right system, you can tackle the biggest denial culprits in 30 days or less.

I’m not talking about a temporary patch. I’m talking about building habits and processes that will keep your claims clean and your revenue flowing month after month. Let me show you exactly how.

Why Claim Denials Are More Than Just Paperwork Headaches

Before we dive into the fixes, let’s get real about what denials actually cost you. It’s not just the claim amount itself. Think about:

- Staff time spent reworking and resubmitting

- Delayed payments that strain your cash flow

- Lost revenue from claims that never get resubmitted (yes, this happens more than you’d think)

- The emotional drain on your team dealing with constant rejection

The American Medical Association says nearly 20% of all claims get denied initially. But here’s what they don’t tell you upfront: Over 60% of those denials never get resubmitted. That’s pure profit walking out the door.

The secret I’ve learned? You don’t need to fight every denial. You need to prevent the common ones from happening in the first place. And that’s exactly what we’re going to tackle.

Your 30-Day Action Plan to Conquer Denials

Think of the next month as your practice’s “denial detox” period. We’re going to systematically tackle each major denial category, one week at a time. By month’s end, you’ll have cleaner claims, faster payments, and a whole lot less stress.

Ready? Let’s roll up our sleeves.

Week 1: Tame the Eligibility Beast (The #1 Denial Culprit)

If I had a dollar for every time I’ve seen an insurance eligibility issue cause a denial, I could probably retire. This is consistently the biggest offender, accounting for about 25-30% of all denials.

The Problem: Patients’ insurance information changes more often than people change their minds about what to watch on Netflix. But if your front desk is working with outdated data, you’re essentially sending claims into a black hole.

Your 7-Day Fix:

- Implement a “Double-Check” Protocol: Every patient, every visit. Train your front desk to verify insurance at two points:

- When the appointment is scheduled

- When the patient arrives (using an electronic eligibility check)

- Create Simple Eligibility Cheat Sheets: Different insurers have different portals and processes. Make one-page guides for each major payer in your area.

- Address the “But We Checked It Last Time” Myth: I hear this all the time. Insurance can change mid-treatment, especially with:

- Job changes

- Plan renewals

- Dependent status changes

- Medicare/Medicaid updates

Week 2: Clean Up Your Coding Act

Coding errors are like typos in a love letter—they change everything. These denials hurt because they’re often seen as “your fault” by payers, making them harder to appeal.

The Most Common Coding Mistakes I See:

- Incorrect E/M Levels: Are you consistently undercoding for fear of audits? Or overcoding and raising red flags?

- Mismatched Diagnosis & Procedure Codes: The story has to make sense to the insurance reviewer.

- Missing or Invalid Modifiers: Those little two-digit codes matter more than you think.

- Unbundling Services: Accidentally billing separately for services that should be packaged.

Your 7-Day Coding Cleanup:

Days 1-2: Conduct a Mini-Audit

Pull 20 denied claims from the past month. How many were coding-related? Look for patterns.

Days 3-4: Update Your Code Reference Sheets

Medicine changes. Codes change. Make sure your cheat sheets and software are updated for this year’s changes. Don’t rely on memory alone.

Days 5-7: Implement a “Second Set of Eyes” Rule

For any claim over a certain dollar amount (you set the threshold), require a second team member to review the codes before submission.

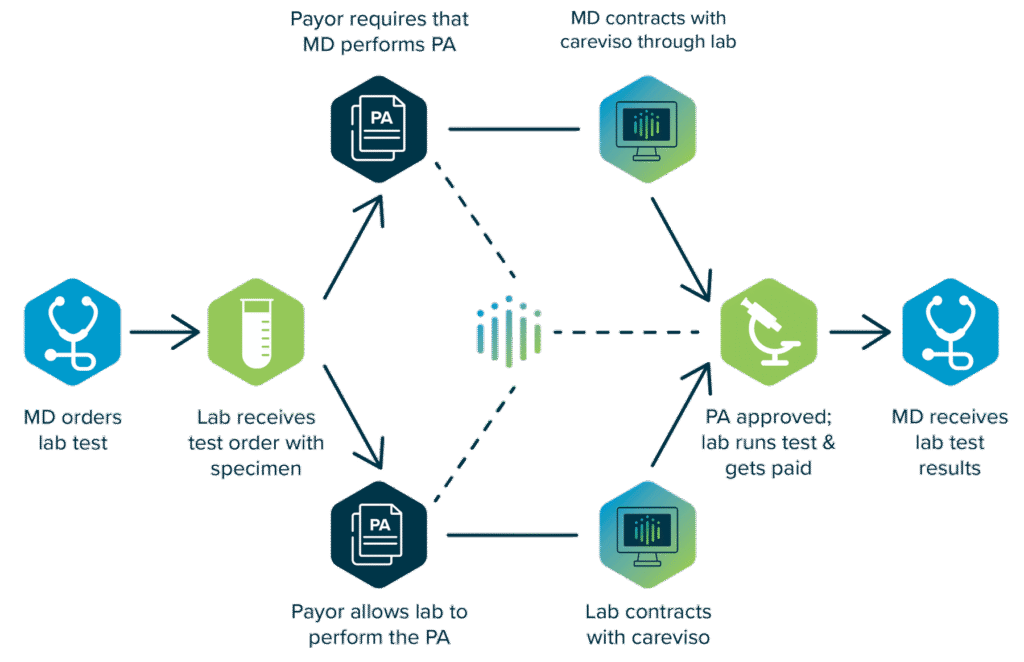

Week 3: Master the Prior Authorization Maze

Ah, prior authorizations—the necessary evil of modern healthcare. The denial that stings the most because you often don’t discover it until after the service is rendered.

Why This Happens:

- Changing payer requirements

- Staff assuming “we’ve always done it this way”

- Urgent cases where there’s no time to wait

- Simple human error

Your 7-Day Authorization Overhaul:

Step 1: Create a Master Payer Requirement Grid

This changed everything for a dermatology practice I consulted with. They made a simple spreadsheet listing:

- Which procedures need auth for each major insurer

- Timeframes required

- Contact numbers and portal links

- Common reasons for denial

Step 2: Implement a “No Auth, No Schedule” Policy

For non-emergent services, this is non-negotiable. It feels strict at first, but it prevents so many headaches.

Step 3: Designate an “Auth Specialist”

Even in small practices, having one person become the go-to for authorization questions reduces errors dramatically.

The Hidden Benefit: When you track which services frequently need auth, you can start conversations with payers about why certain medically necessary treatments are being gatekept.

Week 4: Conquer Timely Filing Deadlines

Missing a filing deadline isn’t just a paperwork error—it’s throwing money away. Once an insurer’s clock runs out, that claim is gone forever. I’ve seen practices lose tens of thousands simply because a deadline slipped through the cracks.

Here’s how to lock down your timelines in one week:

Day 1: Know Your Deadlines

They vary wildly:

- Medicare: 1 calendar year from service date

- Medicaid: 90 days to 1 year (varies by state)

- Commercial payers: Usually 90–180 days

- Some plans: As little as 30 days

Days 2–3: Create a Filing Calendar

Use a shared digital calendar color-coded by payer. Set automated reminders 30, 15, and 5 days before each deadline.

Days 4–5: Attack Your Backlog

Tackle older claims first. Something is better than nothing.

Days 6–7: Submit Daily, Not Weekly

Stop saving claims for “billing day.” Submit clean claims daily to avoid last-minute rushes and missed deadlines.

Real Result: A physical therapy clinic I worked with recovered $23,000 in one quarter just by switching to daily submissions.

Week 5 and Beyond: Build Your Denial-Proof Foundation

You’ve tackled the big five. Now, make sure they don’t come back.

Your 3-Part Prevention System

1. The Daily Denial Dashboard

A one-page snapshot each morning:

- Total claims submitted

- Denials received

- Top denial reasons

- Aging of denied claims

Review it in 5 minutes with your billing lead.

2. Monthly Denial Review Meetings

30 minutes each month to:

- Review denial trends

- Analyze 2–3 denial “case studies”

- Brainstorm improvements

3. Quarterly Payer Performance Report

Track which insurers deny most and why. Use this data in contract negotiations.

Start Today

Fixing denials takes effort, but thriving practices aren’t those with zero denials—they’re the ones with systems to handle them.

Your next step: Gather your team this week. Review your last 20 denials. That alone will show you where to start. Then pick your first weekly focus and begin.